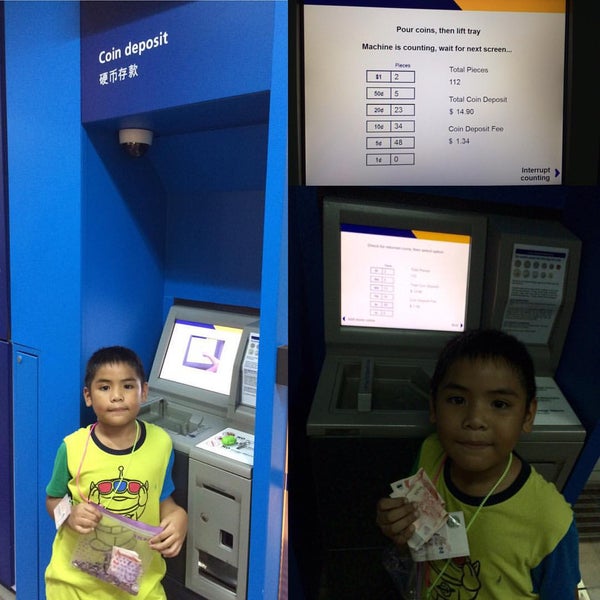

Posb Coin Deposit

This is so as the coin deposit machine charges a fee of S$1.20 per 100 coins, or S$0.012 per piece - regardless of denomination. And POSB Child Development Account. CDF Coin Deposit Fees CDM Deposit (Coin Deposit Machine) CDP Dividends/Cash Distribution CES Inland Revenue Authority of Singapore (Cess). Swimming in coins now. Can I use DBS coin deposit machine to other bank? Or can I convert to cash? Here's the homework I done for the charges:-OCBC S$1.50 / 100 coins S$15 / 1000 coins Singapore Mint / MAS $3.50 / 1000 coins POSB S$1.20 / 100 coins S$12 / 1000 coins. POSB has the one of the first coin deposit machine in Singapore and it’s available only in few branches. It’s not free and it does charge 1.5 cent for every coin deposited. Lots of fun with family to count coins kept in our piggie bank over the years. After counting the coins we went over to the coin deposit machine to deposit a.

POSB Bank Account Opening, there are various channels which you may open a new account with us. The most convenient method would be via digibank Online or digibank Mobile.

New to Bank Customers

- Online application

- Choose an account from the table below and click Apply now.

- If this is your first account with us, select I have none of the above and fill up your account application details.

(Retrieve your details via MyInfo using your SingPass ID and Password for hassle free form filling.) - Documents Required for Account Opening Accounts

(Click for more info)DescriptionApplication DBS Multi-Currency Autosave Account An all-in-one account to save and transact in SGD and foreign currencies. Applicable for Singaporeans and PRs. Apply Now - DBS Multiplier Account Earn up to 3.5% p.a. on your savings. No minimum salary credit. No minimum credit card spend. Plus, save and transact in SGD and foreign currencies in one account. Apply Now

- eMySavings Account A special savings account that allows you to save monthly in a hassle-free way. Apply Now

- POSB Everyday Savings Account A savings account designed for your everyday banking needs and comes with eStatements. Apply Now

- POSB Current Account The POSB Current Account gives you the convenience of issuing cheques, while earning interest on your linked savings account, all at the same time. Apply Now

- POSB SAYE Account Enjoy extra 2% p.a. interest when you credit your salary and have successful monthly saving with us. Apply Now

- POSB Payroll Account A specially designed account for Work Permit worker to receive salary payment. Apply Now

- Branch application

- Locate a Branch by using our Locator.

- Documents Required for Account Opening

Existing Customers

- Online application

- Choose an account from the table below and click Apply now.

- Documents Required for Account Opening Accounts

(Click for more info)DescriptionApplication DBS Multi-Currency Autosave Account An all-in-one account to save and transact in SGD and foreign currencies. Applicable for Singaporeans and PRs. Apply Now - DBS Multiplier Account Earn up to 3.5% p.a. on your savings. No minimum salary credit. No minimum credit card spend. Plus, save and transact in SGD and foreign currencies in one account. Apply Now

- eMySavings Account A special savings account that allows you to save monthly in a hassle-free way. Apply Now

- POSB eEveryday Savings Account A savings account designed for your everyday banking needs and comes with eStatements. Apply Now

- POSB Current Account The POSB Current Account gives you the convenience of issuing cheques, while earning interest on your linked savings account, all at the same time. Apply Now

- ePOSBkids Account

Your child’s first savings account, earn daily interest and enjoy waiver of coin deposit fee* until your child turns 16 years old.

*Waiver is limited to first 1000 pieces per calendar month at the coin deposit machine.Apply Now - POSB SAYE Account Enjoy extra 2% p.a. interest when you credit your salary and have successful monthly saving with us. Apply Now

- Singapore Dollar Fixed Deposit Save a fixed amount for a fixed tenor at competitive interest rates with the Singapore Dollar Fixed Deposit. Apply Now

- Foreign Currency Fixed Deposit Enjoy potentially better returns and the opportunity to grow your funds with Foreign Currency Fixed Deposit. Apply Now

- Supplementary Retirement Scheme Supplementary Retirement Scheme (SRS) lets you save for your retirement and enjoys tax benefits. Apply Now

Note:

- Accounts will be opened instantly for applications submitted via digibank Online or digibank Mobile between Monday to Sundays (including Public Holidays), 0700 hr to 2230 hr.

Submission cut off timing for last day of the month (including Public Holidays) is 0700 hr to 2000hr. - For applications submitted beyond the period stated via digibank Online or digibank Mobile will take 2 working days to complete.

- Once your account is opened, you will receive a notification in the “Notifications” service on digibank Online. The account number will be stated in the notification.

For Online Account Application, you will need to upload photos or scanned copies of the required documents. For Branch Account Application, you will need to bring along the physical copy of the required documents.

Part of: Guides > Your Guide to digibank Online

Singaporean/Permanent Resident

- *Front & Back of NRIC (if applicable); and

- Latest copy (last 3 months) of any of the items below as Proof of Residential/Mailing Address (where applicable).

- Local utility bill

- Local telecommunication bill

- Local bank statement/credit card statement

- Letter issued by government of other public bodies regulated for AML practices in a FATF member country

- Letter from regulated insurance companies in a FATF member country

- Letter from school (restricted to official letters from educational institutions or schools under the purview of Council for Private Education or Ministry of Education)

Note:

- *Application will be rejected, should the name and residential/mailing address (where applicable) on the document differ from that on your NRIC and Application Form.

- For the proof of residential/mailing address (where applicable) document, please ensure the residential/mailing address (where applicable) and date of issued are visible on the photos/scanned copies.

- For ePOSBkids Account Opening, please bring along your child’s original birth certificate, if your child is a Singaporean/PR; or your child’s original passport, if your child is a foreigner.

Foreigner (Working in Singapore)

- *Passport (biodata page); and

- *Employment pass; and

- Latest copy (last 3 months) of any of the items below as Proof of Residential/Mailing Address (where applicable).

- In Principal Approval (IPA) issued by Ministry of Manpower

- Work permit of foreign domestic worker (domestic helper) issued by Ministry of Manpower

- Letter of offer

- Letter of employment

- Latest payslip

- Local utility bill

- Local telecommunication bill

- Local bank statement/credit card statement

- Letter issued by government of other public bodies regulated for AML practices in a FATF member country

- Letter from regulated insurance companies in a FATF member country

- Letter from school (restricted to official letters from educational institutions or schools under the purview of Council for Private Education or Ministry of Education)

Note:

- *Applications will be rejected should the name and passport / employment pass number listed on your application form and on the document differ from that on your Passport and Employment pass and application form.

- For the proof of residential/mailing address (where applicable) document, please ensure the residential/mailing address (where applicable) and date of issued are visible on the photos/scanned copies.

- For ePOSBkids Account Opening, please bring along your child’s original birth certificate, if your child is a Singaporean/PR; or your child’s original passport, if your child is a foreigner.

Foreigner (Studying in Singapore)

- *Passport (biodata page); and

- Matriculation card / Student card (includes In-Principle Approval by ICA)

Or

Letter from school (restricted to official letters from educational institutions or schools under the purview of Council for Private Education or Ministry of Education); and - Latest copy (last 3 months) of any of the items below as Proof of Residential/Mailing Address (where applicable).

- Local utility bill

- Local telecommunication bill

- Local bank statement/credit card statement

- Letter issued by government of other public bodies regulated for AML practices in a FATF member country

- Letter from regulated insurance companies in a FATF member country

- Letter from school (restricted to official letters from educational institutions or schools under the purview of Council for Private Education or Ministry of Education)

Note:

- *Applications will be rejected should the name listed on the document differ from that on your Passport and Application Form.

- For the proof of residential/mailing address (where applicable) document, please ensure the residential/mailing address (where applicable) and date of issued are visible on the photos/scanned copies.

- For ePOSBkids Account Opening, please bring along your child’s original birth certificate, if your child is a Singaporean/PR; or your child’s original passport, if your child is a foreigner.

DBS/POSB ATM and Cash Deposits Machines Locations

DBS/POSB ATM and Cash Deposits Machines Locations

locator.dbs.com

Common Questions on CAM (Cash Acceptance Machines)

| Q: | What is a Cash Acceptance Machine (CAM)? | |

| ANS: | It is a 24-hour self-service banking terminal, which accepts cash deposits using ATM card or POSB passbook. Do note some of our touch-screen machines can be activated without use of your card or passbook to deposit to your preferred accounts. But personally I note that for some branches after midnight, the Deposits Machines do not accept any more cash. Probably because the machines go under maintenance after midnight, in the early hours of morning. Also do take care when depositing money, there's a 'horror story' in year 2010 about the ATM taking away $800 from an elderly man (read below)

ANS: Only Singapore Dollar currency is accepted. The accepted denominations are S$10, S$50 and S$100 (Ship and portrait series only). In addition to above currencies, we also have some touch-screen machines that accept $1000 bills. You can touch screen to begin transaction with the option to use your card/book or without. Q Standard Operating Hours? ANS The deposit service is available 24 hours a day, 7 days a week. Passbook updating service is available between 7 am to 11 pm daily. However, do note above subject to bank’s system maintenance and other activities. Please call our bank should you need to find out more. |

ACCORDING to retiree A. P. Chong, he fed $2,800 in notes into a bank cash-deposit machine in Upper Cross Street only to find, to his horror, that the system had acknowledged a deposit of only $2,000.

After an investigation, DBS Bank maintained that that is all the 65-year-old fed in.

But Mr Chong is sticking to his story. He insists he was entrusted with $2,800 in savings by a few elderly relatives, and he was banking the sum into his decades-old POSB savings account.

He broke up the wad of cash into smaller instalments of $10 and $50 notes that June 10 evening, and fed each in turn into the machine, he said.

But, when the former accountant scrutinised the receipts issued by the machine, he found that they recorded a total deposit of only $2,000.

He called the bank's customer hotline an hour later to report the matter, and was told that the bank would need some time to conduct investigations.

Mr Chong, who said he has been using automated banking services for years, wanted prompt action.'A whole month has passed before presenting me with these findings. Why couldn't the bank check the machine immediately after I reported the incident? Anything could have happened during the time in between,' he said.

When this reporter attempted to deposit cash in batches at the same CDM, it took so long for a receipt to be issued that a call was made to the DBS helpline.

A customer-service officer was able to rattle off details of every single transaction made in the past five minutes. She also promised that the problem encountered would be taken care of.

Meanwhile, Mr Chong continues to hope that the $800 he insists is at large will turn up.

'I've lodged another complaint with the bank, and will wait for them to get back to me,' he said wistfully.

You can read more of the story here:

http://www.asiaone.com/Business/News/My+Money/Story/A1Story20100818-232620.html