Pnc Bank Cd Rates

- PNC Bank currently has some of the best promotional CD rates and best savings rates available from any online bank, which is a stark contrast to their standard CD rates. The current savings rate at PNC Bank.

- Information on PNC Bank 6 Month CD Rates: A 6 month CD by PNC bank is considered a retail certificate interest-bearing deposit and the consumer with this product has an upfront fixed rate of return for the six month CD.

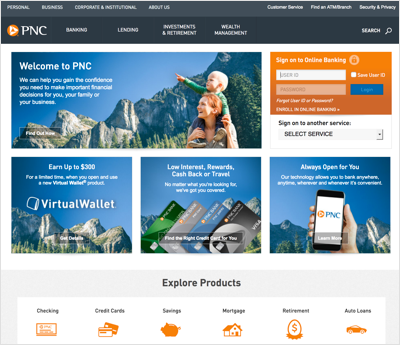

PNC Bank has 2,600 branches in 19 states mostly on the East. Checking accounts offer a unique Virtual Wallet feature with financial tools to help achieve goals. Account fees are easily waived by meeting account balance or direct deposit requirements.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/15849068172000508-1e1a333fb85a40d2980e4ff8eafc740d.jpeg)

Checking Account Bonuses

PNC Bank frequently offers cash bonuses for new checking customers. Some deals are only available for residents of select States, so make sure you read the fine print carefully.

At the end of your Promotional term, your account will automatically convert to the standard CD term that is closest to but not greater than your original CD term based on the following standard CD terms: 6, 12, 18, 24, 36, 60 month terms. In addition, your CD rate will convert to the rate applicable to the standard CD term.

All PNC Bank checking accounts offer free online banking, bill pay, and mobile deposits.

Pnc Bank Cd Rates New Jersey

Virtual Wallet Account

This is PNC Bank's signature product. This can be paired with any of PNC Bank's checking accounts. Here are some features:

- Checking & Savings together. You get a checking account (Spend), a short-term savings (Reserve), and high-interest savings (Growth) account. These accounts are designed to help achieve your current banking needs and short-term and long-term goals.

- Financial tools. This is the biggest perk of the Virtual Wallet account. There are a variety of financial tools to help you create a budget, keep track of your spending, set up goals, save, get 'danger days' alerts, and more.

- Automatic overdraft protection. If you overdraw your Spend account, funds from your Reserve account will automatically be transferred to cover the overdraft. If you need it, your Growth account can serve as your secondary overdraft protection account.

- Earn relationship rates. When you meet certain debit card or direct deposit requirements, you'll earn the higher relationship rate on your Growth account for the following month.

- ATM fee reimbursement. Depending on which Virtual Wallet account you have, you can have some or all of non-PNC ATM fees reimbursed.

How to Avoid PNC Bank Checking Account Fees

Pnc Bank Cd Rates In Illinois

PNC Bank offers these standard checking accounts:

- Standard Checking. The $7 monthly service fee can be waived if you: maintain an average account balance of $500, OR have combined monthly direct deposits of at least $500, OR are age 62 or older.

- Performance Checking. The $15 monthly service fee can be waived if you: maintain an average account balance of $2,000, OR have combined monthly direct deposits of at least $2,000 ($1,000 for WorkPlace Banking or Military Banking customers), OR have a combined balance of at least $10,000 in PNC deposit accounts, loans, and investments.

- Performance Select Checking. The $25 monthly service fee can be waived if you: maintain an average account balance of $5,000, OR have combined monthly direct deposits of at least $5,000, OR have a combined balance of at least $25,000 in PNC deposit accounts and investments.

Pnc Bank Cd Rates Michigan

In addition to standard checking, PNC Bank also offers these Virtual Wallet checking + savings accounts:

Pnc Bank Cd Rates 1 Year

- Virtual Wallet Checking. The $7 monthly service fee can be waived if you: maintain an average monthly balance of $500 in Spend and Reserve, OR have at least $500 in direct deposits per month to the Spend, OR are a qualified student, OR are age 62 or older.

- Virtual Wallet with Performance Spend. The $15 monthly service fee can be waived if you: maintain an average monthly balance of $2,000 in Spend and Reserve, OR have at least $2,000 in direct deposits per month to the Spend ($1,000 for WorkPlace Banking or Military Banking customers), OR have a combined balance of at least $10,000 in PNC deposit accounts, loans, and investments.

- Virtual Wallet with Performance Select. The $25 monthly service fee can be waived if you: maintain an average monthly balance of $5,000 in Spend and Reserve, OR have at least $5,000 in direct deposits per month to the Spend, OR have a combined balance of at least $25,000 in PNC deposit accounts and investments.

- Virtual Wallet Student. There is no monthly service fee with proof of active student status for 6 years.