Pnb Bank Interest Rates

- Pnb Bank Interest Rates Money Market

- Pnb Interest Rate Fd

- Punjab National Bank Interest Rates

- Pnb Bank Interest Rates Auto Loans

- Pnb Saving Bank Account Opening

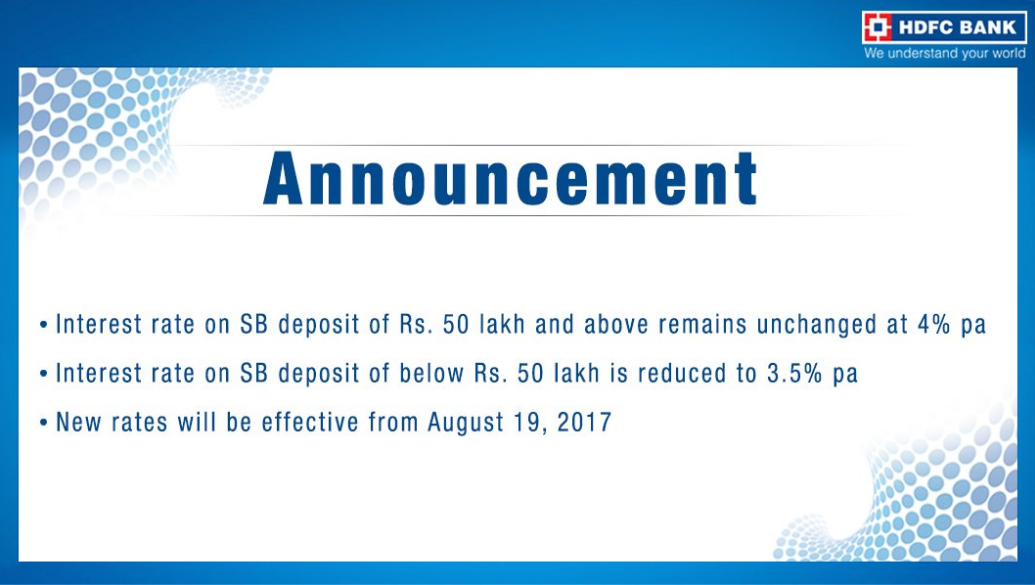

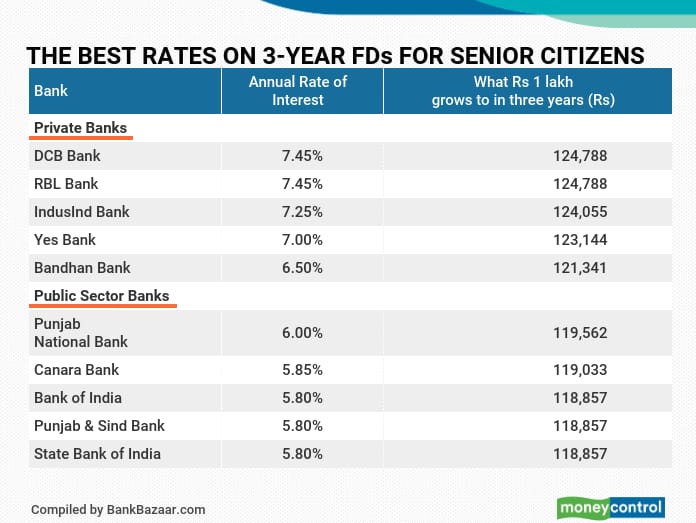

Where any transaction account is overdrawn, interest will be charged on the overdrawn balance and will be calculated daily at 16.69% p.a. And charged to the account in accordance with the dates detailed. Punjab National Bank (PNB) FD Rates 2021 Updated on February 11, 2021, 12130 views. Punjab National Bank (PNB) offers competitive Fixed Deposit interest rates and a wide range of other benefits such as. Majority of public sector banks usually pay interest between 3.5% to 4% based on amount deposited but private banks offer higher interest on savings account. According to RBI guidelines, Savings Bank. PNB Bank Home Loan Interest Rates in Feb - 2021: Interest rate. Loan turnaround period. Loan to value (LTV) Get loan up to 85% of the project cost.

PNB-Verify is a device binding solution for Retail Internet Banking users, by which user can authenticate transaction using Mobile Application through App notification instead of using the SMS based OTP, as second factor of authentication. To enroll for PNB Verify navigate as: Personal Settings -> Enroll for PNB Verify

PIHU (PNB’s Instant Help for yoU) - responds to customer queries (FAQs) related to Retail Internet Banking, Mobile Banking and Debit Card.

Now you may apply for Sovereign Gold Bond through Retail IBS by using the navigation: Other Services-> Sovereign Gold Bond -> Purchase SGB.

Now you may link your GSTIN through IBS by using the navigation: Other Services-> Register for Govt. Initiatives-> GSTIN Registration.

Get your PAN linked with your account through IBS by using the navigation: Other Services-> Register for Govt. Initiatives-> PAN Registration

To Prevent Fraudulent Payment of Cheques in your Accounts, Please Avail PNB Suraksha Scheme

Link Demat Account With Your IBS User ID and Get Details Of Holding in the Demat account in the Statement of Transaction

Please Download latest version of PNB UPI from Play Store to Enjoy Enhanced Features.

What's New

PNB-Verify is a device binding solution for Retail Internet Banking users, by which user can authenticate transaction using Mobile Application through App notification instead of using the SMS based OTP, as.

A Savings Account is very beneficial with multiple advantages as detailed below:

(1) Earns Interest on your Savings

This is the first and foremost benefit of opening a savings account. It starts earning interest on your money as soon as it is deposited. The interest rate is decided solely by the bank and changes from time to time. Regular interest depends upon the balance of the savings account.

Interest rate in savings account ranges from 3.5% to 7%.

(2) Provides Security of Funds

There is no risk involved in your savings account. It is considered as one of the safest investment alternatives. It even offers you the opportunity to put your money into another investment whenever the time comes.

(3) No Lock-in Period

There is no lock-in period under savings account which means that you can withdraw your deposits anytime you need. There is no need to keep your money in this account for any specific period. You have full flexibility in withdrawal of amount from it.

(4) Offers Liquidity

You can withdraw the amount anytime 24X7 with the use of ATM card or debit card from your account during any emergency even when the bank is closed. In fact, being able to access your money when you need it, is one of the biggest benefit of having a savings account.

(5) Availability of Variety of Savings Account

Many banks offer comprehensive range of savings accounts from regular to premium suiting to your personal banking needs. There are different types of savings accounts offered by various banks that differ based on the interest rates and duration of time commitments. You can choose any of them which suits your financial objectives and requirements.

(6) Services of Customer Relation Manager

Pnb Bank Interest Rates Money Market

Now-a-days many of the banks engage a Customer Relation Manager (CRM) who will help not only solve your queries but also assist you in tax saving, investment, mutual fund schemes, insurance, bank procedures, etc. You need to just call your CRM and he/ she will assist you solve your problem.

(7) Online Banking Facilities

If you maintain a savings account, you can make many transactions online also such as payment of bills, fund transfers using RTGS/ NEFT or IMPS, etc. This will save your time and efforts.

(8) Provides ATM/ Debit Card

You will be offered a debit or ATM card with a nominal charge or without any charges, as offered by your bank. With the help of this card, you can withdraw the funds, make transactions in shops, make payments of bills, etc.

(9) Helps you Get Credit or Loan

The relation you maintain with the bank will help you in getting credits from the bank such as home loan, personal loan. You will also be in a position to negotiate with the banker on the interest rates.

(10) No Cap on Deposits

There is no limit on the amount deposited and number of times it is deposited.

Pnb Interest Rate Fd

(11) Facility to link Loan EMIs, Mutual Fund SIPs or RD deductions

Punjab National Bank Interest Rates

Pnb Bank Interest Rates Auto Loans

You get a facility to link your monthly loan EMIs, Mutual Fund SIPs or RD deductions through the savings bank account.

(12) Free Mobile App

Pnb Saving Bank Account Opening

Most of the banks provide their mobile app for free. Through this app, you can get to know your account balance, check your statement, make transactions, easy transfer of money, etc.