Mobile Check Deposit Chime

- Mobile Check Deposit Chime

- How To Add Money To Chime Card

- Mobile Check Deposit Chime Reddit

- How Long Mobile Check Deposit Chime

Ingo Money is a service provided by First Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions https://www.ingomoney.com/terms-conditions/general-sdk/ and Privacy Policy https://www.ingomoney.com/privacy-policy Approval review usually takes 3-5 minutes, but may take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Unapproved checks will not be loaded to your card. Ingo Money reserves the right to recover funds from bad checks if you knew the check was bad when you submitted it, if you attempt to cash or deposit it elsewhere after funding or if you otherwise act illegally or fraudulently. Fees may apply for loading or use of your card. See your Cardholder Agreement for details. Fees and other terms and conditions apply to check load services.

Neither Green Dot account, Green Dot Bank, Green Dot Corporation, Visa U.S.A. or any of their respective affiliates provide or are responsible for Ingo Money Products or Services.

App Store is a service mark of Apple Inc. Google Play is a trademark of Google Inc.

Deposit your check with Altra Mobile Deposit and it goes into your account within about a minute. Please read disclosure for exceptions to “Real Time”. All checks deposited through Altra Mobile Deposit must be endorsed with your signature in the designated endorsement area and must include the words “For mobile deposit – Altra.” If. Ask the cashier to make a deposit directly to your Chime Spending Account. You can make up to 3 deposits every 24 hours. You can add up to $1,000.00 every 24 hours for a maximum of $10,000.00 every month. Third-party money transfer services that are used to add funds to your Chime Spending Account may impose their own fees or limits such as.

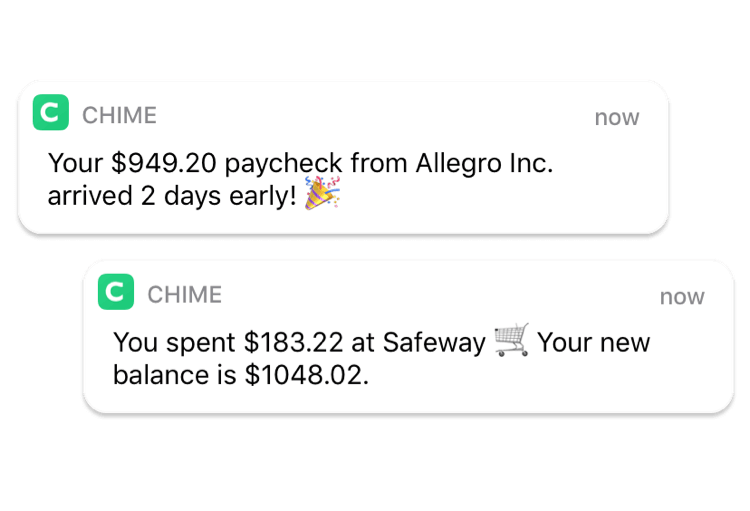

This phone number is Chime's Best Phone Number because 606 customers like you used this contact information over the last 18 months and gave us feedback. Common problems addressed by the customer care unit that answers calls to 844-244-6363 include Account Access, Problem With the App, Overcharge on Account, Trouble Receiving a Payment, Missing. With the early direct deposit feature, your direct deposit will be posted to your Chime Spending Account as soon as it is received from your employer or payer. If you have questions about the timing of your direct deposit please contact your employer. Bank Transfer Initiated Through the.

© 2020 Ingo Money, Inc. All rights reserved.

Learn how to perform a mobile check deposit at the many places that allow for such deposits.

First, we define what mobile check deposit or loading entails before outlining the specific steps on how to carry out the process.

You will also learn more about fake check deposits, fraud, and penalties for handling fake checks.

Contents

- How do mobile check deposits work?

- Mobile deposit fake check – Fraud & Penalties

- FAQ on Mobile Check Deposit

What is a mobile check deposit?

The mobile check deposit is a smart feature that enables people to easily and conveniently deposit their checks from their geographical locations.

You do not have to travel long distances to an ATM or bank branch to receive these services. However, for one to do that, he or she must have either a tablet or a smartphone with an app of their preferred bank.

How do mobile check deposits work?

The process of depositing your checks using this feature is as simple as taking a selfie using your phone.

A picture displays all the physical traits of a given object, and therefore, enabling the bank apps software to process the checks, once the images have been uploaded.

Mobile Check Deposit Chime

All you have to do is capture the back and front of your check. The picture of the check has to show both the front and back features for it to be processed effectively.

It is also one of the approaches to confirming that indeed the check is yours.

An individual may secretly take a picture of other people’s checks and upload only one side; so, if one side is acceptable, it will facilitate the theft of checks.

After you have uploaded the image of your check, you are expected to select the bank account where to deposit, enter the amount, and approve the details.

The amount entered has to match what is written on the check. For instance, if it is $3,000.00 on the check, the keyed-in figure must be $3,000.00.

Before, submitting the check for processing, you are required to confirm the details. Affirmation of the details assists in the elimination of the possible errors, which could delay the process of depositing your check.

It also removes the possibility of having the money deposited in the wrong bank account.

Lastly, after completing the above steps and have submitted the check, you will receive a notification informing you whether or not your check has been deposited.

If the check is rejected, you will be given a chance to review and repeat the steps above to deposit your check.

However, if the check is rejected completely, kindly contact the customer care of your bank for further details and assistance regarding their mobile check deposit services.

How does a mobile check deposit work at Bank of America?

For you to enjoy the banking services through your smartphone or tablet, you need to download the Bank of America app. You can get the app through this link here.

After downloading the app, you should install and register by opening the app. Once you have done that, you can deposit the check by taking the front and back of your check, enter the account and then tap ‘make a deposit.’

How does mobile check deposit work Wells Fargo?

As their customer, sign on to your Wells Fargo Mobile application, then upload the front and back of your check, enter the amount you want to deposit as written on the check, and submit for processing.

How does mobile cheque deposit work at RBC?

The RBC Mobile app is available at the App Store and Google Play, or one can send a text “RBC” to 722722 and the bank will send you the link.

Once you have the app, all you need to do is sign the front and the back of your check, take images, upload, and submit the correct detail for processing.

How does Chime’s mobile check deposit work?

The Chime application is available for Android and iPhone smartphone users. Once you have installed the app on your phone, you can deposit checks from any part of the world.

However, you must ensure the check pictures and details are correct and clear to prevent the cancellation of the check.

How does the PNC mobile check deposit work?

At PNC, clients are allowed to deposit checks through their smartphones. The customer care team is always accessible to guide clients on how to do it.

However, the process is simple, as one is only required to send the picture of their correctly filled checks for processing.

How does Citibank’s mobile check deposit work?

Customers using the Citibank app are expected to only key in the details of their check as it appears in the images of their checks and submits them for processing.

The process takes less than 30 minutes before the check is fully processed and confirmed.

How does Fidelity mobile check deposit work?

On the Fidelity mobile app, you are required to tap the ‘deposit checks’ option and follow the steps to successfully deposit your check from your locality without having to visit the bank.

However, if the pictures of your uploaded checks are not clear, the process may be canceled.

Mobile deposit fake check – Fraud & Penalties

How To Add Money To Chime Card

Counterfeit checks are usually rejected instantly after confirmation. Individuals can engage in these illegal activities by stealing checkbooks and making fake stamps.

In other instances, individuals can steal checks and attempt to deposit them through mobile apps, and giving false information, hoping the process will be successful.

Individuals who are found engaging in fake check businesses can be imprisoned or fined heavily, depending on the state laws of a particular country.

In other states, the suspects can both be fined and jailed when found guilty of dealing with fake checks.

I deposited a fake Check into my Account (or an ATM)!

Attempting to deposit a fake check into your ATM or account will raise integrity questions about your business and your account may be blacklisted or closed indefinitely until the investigation concerning the matter is complete.

Penalty for Depositing Fake Check

Individuals who are found engaging in fake check businesses can be imprisoned or fined heavily, depending on the state laws of a particular country.

In other states, the suspects can both be fined and jailed when found guilty of dealing with fake checks.

FAQ on Mobile Check Deposit

The following are the questions that are mostly asked across the various platforms about mobile check deposit

Can I deposit a Scanned check?

Yes, you can deposit such a check, but not all banks allow it. So, confirm with your bank by contacting them through their customer care service number.

How does remote deposit capture work?

The remote deposit allows you to snap or scan the image of your checks instead of moving the physical checks around. It happens through an encrypted internet connection to avoid the loss of sensitive information and checks.

Can you go to Jail for depositing a Fake Check?

Mobile Check Deposit Chime Reddit

Yes, you can be jailed as long as it is proven that you intentionally deposited the fake check. Therefore, you need to be careful when depositing checks.

References on Mobile Check Deposit

- 1: What is Mobile Check Deposit?

- 2: Mobile Banking App for iPhone and Android

- 3: What is Remote Deposit Capture?

How Long Mobile Check Deposit Chime

READ: Mobile check deposit availability at Chase ATM