Direct Deposit Account

Federal law mandates that all Federal benefit payments – including Social Security and Supplemental Security Income benefits – must be made electronically.

- Direct Deposit Account Form

- Direct Deposit Account

- Direct Deposit Account Definition

- Direct Deposit Account Chase

- Direct Deposit Account Number

Dec 23, 2020 The new direct deposit limits will help eliminate this type of abuse. Direct deposit must only be made to accounts bearing the taxpayer’s name. Preparer fees cannot be recovered by using Form 8888 PDF to split the refund or by preparers opening a joint bank account with taxpayers.

Direct Deposit Account Form

Direct Deposit Account

There are two ways you can receive your benefits:

- Into an existing bank account via Direct Deposit or

- Onto a Direct Express® Debit Mastercard®

Direct Deposit is the best electronic payment option for you because it is:

- Safe – Since your money goes directly into the bank in the form of an electronic transfer, there's no risk of a check being lost or stolen.

- Quick – It's easy to receive your benefit by Direct Deposit. You can sign up online at Go Direct®, by calling 1-800-333-1795, in person at your bank, savings and loan or credit union, or calling Social Security. Then, just relax. Your benefit will go automatically into your account every month. And you'll have more time to do the things you enjoy!

- Convenient – With Direct Deposit, you no longer have to stand in line to cash your check when it arrives. Your money goes directly into your account. You don't have to leave your house in bad weather or worry if you're on vacation or away from home. You don't have to pay any fees to cash your checks. Your money is in your account ready to use when business opens the day you receive your check.

Direct Deposit Account Definition

If you are applying for Social Security or Supplemental Security Income benefits, you must elect to receive your benefit payment electronically when you enroll. If you currently receive Social Security or Supplemental Security Income benefits by check, you must switch to an electronic payment option listed above.

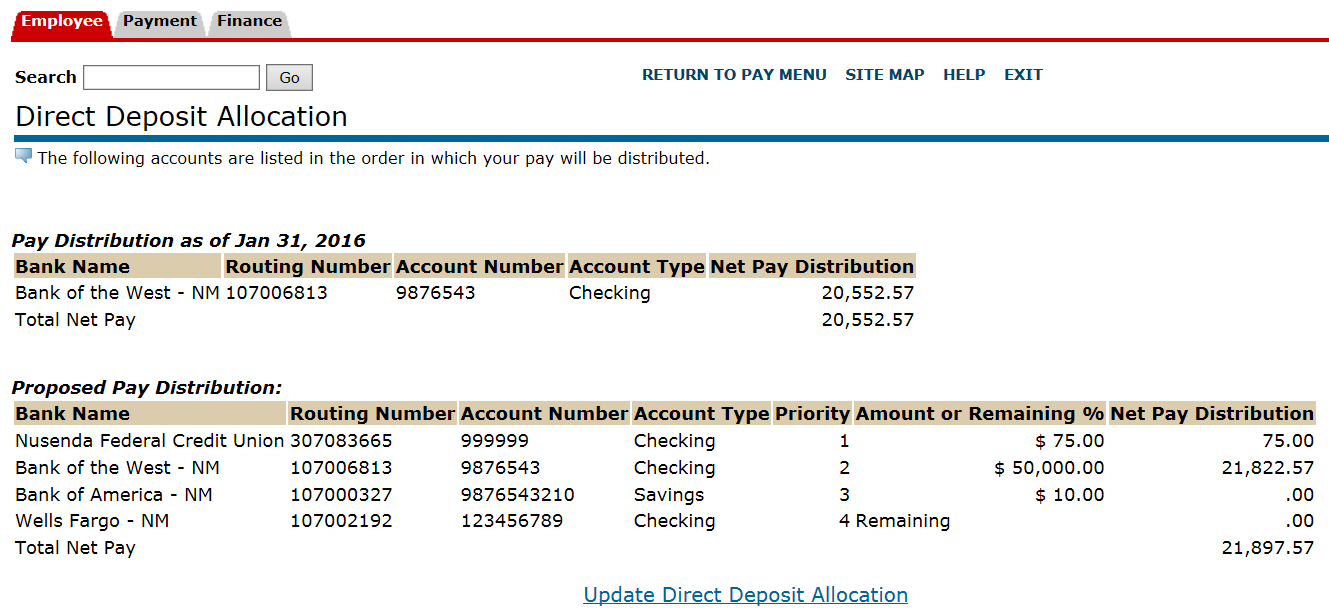

If you already have direct deposit active, you will see a summary of your account information. Click Change to start a new direct deposit or to change an existing direct deposit You'll need you bank name, account number, and routing number to set up direct deposit to your checking or savings account. Into an existing bank account via Direct Deposit or Onto a Direct Express® Debit Mastercard® Direct Deposit is the best electronic payment option for you because it is: Safe – Since your money goes directly into the bank in the form of an electronic transfer, there's no risk of a check being lost or stolen. The IRS program is called direct deposit. You can use it to deposit your refund into one, two or even three accounts. Eight out of 10 taxpayers get their refunds by using Direct Deposit. It is simple, safe and secure. Direct deposit is the deposit of funds electronically into a bank account rather than through a physical, paper check. It requires the use of an electronic network that allows deposits to take.

Direct Deposit Account Chase

To learn more about how to easily switch from a paper check to an electronic payment option, visit Treasury’s Go Direct website or call the Treasury’s Electronic Payment Solution Center at 1-800-333-1795. You can also create a mySocial Security account and start or change Direct Deposit online.

In extremely rare circumstances, Treasury may grant exceptions to the electronic payment mandate. For more information or to request a waiver, call Treasury at 855-290-1545. You may also print and fill out a waiver form and return it to the address on the form.

Direct Deposit Account Number

If you have any questions, call Social Security at 1-800-772-1213 (TTY 1-800-325-0778).